Today, July 22, 2019, the Boston Division of the Federal Bureau of Investigation, the Boston Field Division of the Bureau of Alcohol, Tobacco, Firearms and Explosives, the Boston Police Department, the Brookline Police Department, the Framingham Police Department, the Massachusetts State Police, and the Middlesex Sheriff’s Office announce the opening of the new FBI-sponsored New England Regional Computer Forensics Laboratory (NERCFL) in Chelsea, Massachusetts.

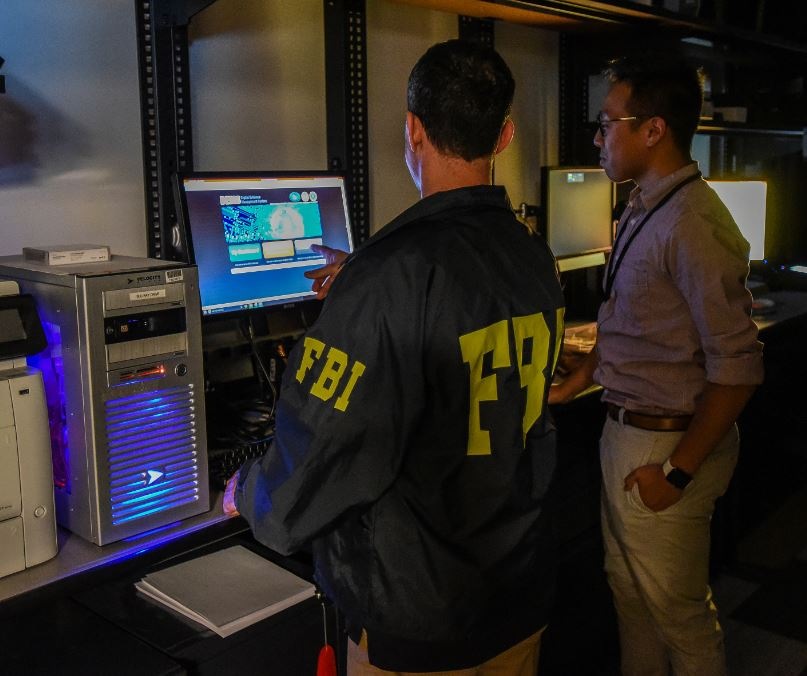

The NERCFL, is part of the Regional Computer Forensics Laboratory (RCFL) program, a national network of FBI-sponsored, full-service forensic laboratories and training centers devoted entirely to the examination of digital evidence, such as computers and mobile devices, in support of federal, state, and local investigations. These laboratories provide the FBI and participating federal, state, and local agencies a powerful tool in investigating criminal and national security cases ranging from terrorism and violent crime to child pornography and trade secret theft. With the addition of this facility, the number of RCFLs nationwide will increase to 17.

Located in Chelsea, Massachusetts, inside FBI Boston Division Headquarters, this laboratory will serve as a critical resource to our region and allow law enforcement to stay competitive with the technology used by the growing number of criminals in our area.

“This new, state-of-the-art laboratory will allow the FBI to expand our forensic capabilities and provide our federal, state, and local law enforcement partners with access to cutting-edge technology in order to address the growing number of cases involving digital media,” said Joseph R. Bonavolonta, special agent in charge, FBI Boston Division. “By combining the extraordinary talents and resources of our partners, we’re increasing our ability to share information and stay on top of current threats.”

The FBI provides the facility, equipment, training, and operational funding, including overtime for the NERCFL and its participating agencies, while those agencies assign personnel to help staff the laboratory.

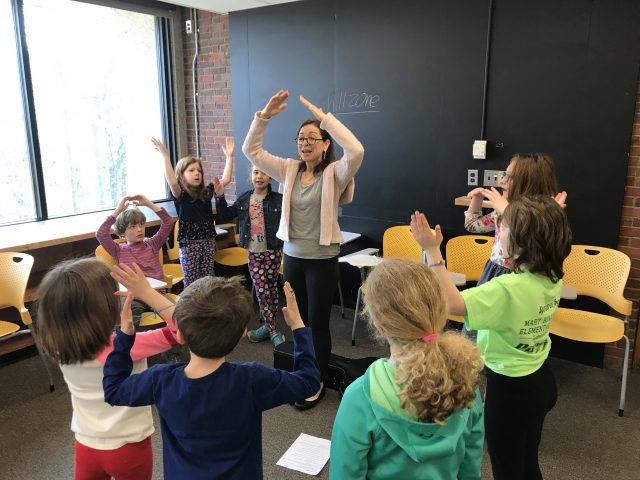

The FBI spends approximately $165,000 on training and equipment for each forensic examiner. In return, they receive sophisticated technical training resulting in Computer Analysis Response Team (CART) Certification as a forensic examiner, access to the most technologically advanced digital equipment available, access to digital forensics examination and advisory services, broad experience in a variety of digital forensics cases, and have a stake in the management of the RCFL.

Today’s announcement underscores how important partnerships are in supporting the NERCFL, which serves as a vital resource for law enforcement agencies throughout New England.

“The New England Regional Computer Forensics Lab is another tool the ATF and our law enforcement partners will now have in combating violent crime. Access to high quality digital forensics will enhance our abilities to put away criminals and make our communities safer,” said Kelly D. Brady, special agent in charge of the Boston Field Division of the Bureau of Alcohol, Tobacco, Firearms and Explosives.

“With the rapid evolution of technology, virtually every case we see has digital evidence. This collaborative new space will provide the Boston Police Department and our law enforcement partners with unprecedented access to tools that will improve our abilities to investigate cases, and fill a critical need for sophisticated training, equipment, and resources while ensuring no one community has to bear the financial burden alone,” added Boston Police Commissioner William G. Gross.

“The Brookline Police Department is honored to have the opportunity to partner with the FBI, ATF, State Police, and our local law enforcement partners to contribute a dedicated investigator to the NERCFL. The training and services provided by the NERCFL are top-notch and at the forefront of an ever evolving and increasingly essential area of sophisticated criminal evidentiary processing. This endeavor will bring great service to the Town of Brookline while also allowing us to contribute to the entire New England region. Thank you to the FBI for leading on this critical public safety need and bringing in local partners like us to work and train at the highest level,” said Chief Andrew Lipson.

“The Framingham Police Department is excited to be part of the new New England Regional Computer Forensics Lab. Having a an officer assigned to this task force not only benefits the Framingham Police Department but also the New England region as a force multiplier. The ever increasing challenges of computer forensic investigations demands the high level training and expertise that these task force members have,” added Chief Steven D. Trask.

The NERCFL will have approximately a dozen FBI trained/certified forensic examiners working collaboratively to support various types of investigations throughout Maine, Massachusetts, New Hampshire, and Rhode Island. “Collection and analysis of evidence from digital devices is an important tool law enforcement agencies use to investigate crime and protect our homeland. We are proud to be a partner in the new Regional Computer Forensics Laboratory and look forward to a close working relationship between this lab and our State Police Cyber Crime Unit and our Digital Evidence Management Unit,” said Massachusetts State Police Colonel Kerry A. Gilpin.

“As digital investigations grow in complexity and the resources required to support them increase, this lab is a great example of the way law enforcement is working jointly to meet those evolving needs. This collaboration enhances our capabilities and training, benefiting agencies across New England,” added Middlesex Sheriff Peter J. Koutoujian.

Subject to availability, the RCFL national program office receives Asset Forfeiture Funds for sworn task force officers assigned to RCFL facilities. In FY 2018, the program received $2.2 million in funding to distribute to eligible task force officers in the form of overtime pay, leased vehicles, and mobile devices.

The lab will seek accreditation through the ANSI-ASQ National Accreditation Board (ANAB). Currently 14 RCFLS hold ANAB Accreditation or its predecessor organization’s American Society of Crime Laboratories Laboratory Accreditation Board (ASCLD/LAB) Accreditation.

For more information on the RCFL program, please visit here.