Teachers Retirement System of The State of Kentucky reduced its stake in Brookline Bancorp, Inc. (NASDAQ:BRKL) by 1.4% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 100,010 shares of the company’s stock after selling 1,400 shares during the period. Teachers Retirement System of The State of Kentucky owned 0.14% of Brookline Bancorp worth $1,641,000 as of its most recent SEC filing.

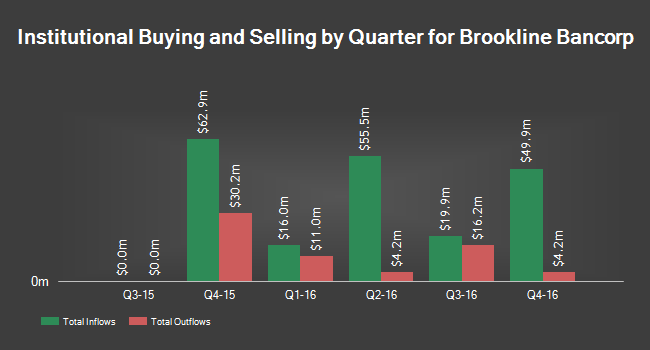

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Russell Investments Group Ltd. bought a new position in Brookline Bancorp during the fourth quarter valued at approximately $26,849,000. BlackRock Fund Advisors boosted its stake in Brookline Bancorp by 9.8% in the third quarter. BlackRock Fund Advisors now owns 4,892,137 shares of the company’s stock valued at $59,635,000 after buying an additional 435,383 shares in the last quarter. Whalerock Point Partners, LLC acquired a new stake in Brookline Bancorp during the third quarter valued at about $4,761,000. State Street Corp boosted its stake in Brookline Bancorp by 9.5% in the fourth quarter. State Street Corp now owns 2,086,950 shares of the company’s stock valued at $34,229,000 after buying an additional 181,257 shares in the last quarter. Finally, Renaissance Technologies, LLC boosted its stake in Brookline Bancorp by 18.3% in the fourth quarter. Renaissance Technologies, LLC now owns 1,118,600 shares of the company’s stock valued at $18,345,000 after buying an additional 173,100 shares in the last quarter. 77.36% of the stock is currently owned by hedge funds and other institutional investors.

Brookline Bancorp, Inc. (NASDAQ:BRKL) traded down 0.97% during mid-day trading on Friday, hitting $15.30. The company had a trading volume of 69,655 shares. The company has a 50-day moving average price of $15.82 and a 200 day moving average price of $14.32. Brookline Bancorp, Inc. has a 12 month low of $10.40 and a 12 month high of $17.45. The firm has a market capitalization of $1.08 billion, a P/E ratio of 20.68 and a beta of 0.88.

Brookline Bancorp, Inc. (NASDAQ:BRKL) traded down 0.97% during mid-day trading on Friday, hitting $15.30. The company had a trading volume of 69,655 shares. The company has a 50-day moving average price of $15.82 and a 200 day moving average price of $14.32. Brookline Bancorp, Inc. has a 12 month low of $10.40 and a 12 month high of $17.45. The firm has a market capitalization of $1.08 billion, a P/E ratio of 20.68 and a beta of 0.88.

The firm also recently announced a quarterly dividend, which was paid on Friday, February 24th. Investors of record on Friday, February 10th were paid a dividend of $0.09 per share. The ex-dividend date was Wednesday, February 8th. This represents a $0.36 annualized dividend and a yield of 2.33%. Brookline Bancorp’s dividend payout ratio (DPR) is 48.65%.

Separately, Compass Point cut Brookline Bancorp from a “buy” rating to a “neutral” rating in a research report on Friday, November 18th.

About Brookline Bancorp

Brookline Bancorp, Inc. operates as a multi-bank holding company for Brookline Bank and its subsidiaries; Bank Rhode Island and its subsidiaries; First Ipswich Bank and its subsidiaries, and Brookline Securities Corp. As a commercially-focused financial institution with approximately 50 banking offices in greater Boston, the north shore of Massachusetts and Rhode Island, the Company offers commercial, business and retail banking services, including cash management products, online banking services, consumer and residential loans and investment services in central New England. The Company’s activities include acceptance of commercial; municipal and retail deposits; origination of mortgage loans on commercial and residential real estate located principally in Massachusetts and Rhode Island; origination of commercial loans and leases to small- and mid-sized businesses; investment in debt and equity securities, and the offering of cash management and investment advisory services.