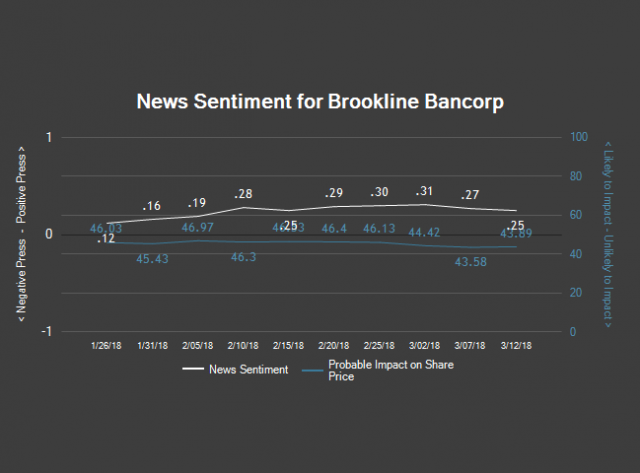

News headlines about Brookline Bancorp (NASDAQ:BRKL) have been trending positive on Wednesday, Accern Sentiment reports. The research group rates the sentiment of press coverage by reviewing more than 20 million news and blog sources in real-time. Accern ranks coverage of companies on a scale of negative one to one, with scores nearest to one being the most favorable. Brookline Bancorp earned a daily sentiment score of 0.29 on Accern’s scale. Accern also gave news coverage about the bank an impact score of 46.3985479397164 out of 100, meaning that recent press coverage is somewhat unlikely to have an impact on the stock’s share price in the next few days.

A number of research firms recently weighed in on BRKL. ValuEngine raised Brookline Bancorp from a “hold” rating to a “buy” rating in a research report on Wednesday, March 7th. Piper Jaffray Companies reissued a “hold” rating and set a $16.50 target price on shares of Brookline Bancorp in a research report on Tuesday, January 9th. Finally, BidaskClub downgraded Brookline Bancorp from a “strong-buy” rating to a “buy” rating in a research report on Thursday, December 7th. Three analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. The stock has a consensus rating of “Hold” and a consensus target price of $16.33.

Brookline Bancorp (NASDAQ BRKL) traded down $0.10 during midday trading on Wednesday, reaching $16.80. The company’s stock had a trading volume of 232,694 shares, compared to its average volume of 352,742. The company has a quick ratio of 1.16, a current ratio of 1.16 and a debt-to-equity ratio of 1.26. The firm has a market capitalization of $1,306.06, a P/E ratio of 25.00 and a beta of 0.91. Brookline Bancorp has a 12 month low of $13.60 and a 12 month high of $17.05.

Brookline Bancorp (NASDAQ:BRKL) last released its quarterly earnings data on Wednesday, January 31st. The bank reported $0.21 earnings per share for the quarter, beating analysts’ consensus estimates of $0.20 by $0.01. The company had revenue of $63.47 million for the quarter, compared to the consensus estimate of $61.22 million. Brookline Bancorp had a return on equity of 7.58% and a net margin of 17.11%. During the same period in the previous year, the business earned $0.19 earnings per share. equities analysts expect that Brookline Bancorp will post 1.05 EPS for the current year.

The business also recently disclosed a quarterly dividend, which was paid on Friday, March 2nd. Shareholders of record on Friday, February 16th were issued a dividend of $0.09 per share. This represents a $0.36 dividend on an annualized basis and a yield of 2.14%. The ex-dividend date was Thursday, February 15th. Brookline Bancorp’s payout ratio is 52.94%.

In other news, Director John A. Hackett sold 5,000 shares of Brookline Bancorp stock in a transaction that occurred on Wednesday, February 7th. The shares were sold at an average price of $16.25, for a total value of $81,250.00. Following the completion of the transaction, the director now owns 31,500 shares in the company, valued at $511,875. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Darryl J. Fess sold 20,000 shares of Brookline Bancorp stock in a transaction that occurred on Tuesday, February 27th. The shares were sold at an average price of $16.49, for a total transaction of $329,800.00. The disclosure for this sale can be found here. Insiders have sold 47,500 shares of company stock worth $784,850 over the last ninety days. Company insiders own 2.85% of the company’s stock.

Brookline Bank is a subsidiary of Brookline Bancorp, Inc. (NASDAQ: BRKL), and is headquartered in Brookline, Massachusetts. A full-service financial institution, Brookline Bank provides individuals and businesses with deposit and lending services, residential mortgages and home equity lending, commercial and CRE banking, cash management, merchant services, and access to investment services. Brookline Bank operates 25 offices in Greater Boston. For more information go to brooklinebank.com. Brookline Bank is an Equal Opportunity and Equal Housing Lender. Member FDIC / Member DIF.

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA/SIPC. Brookline Investment Services is a trade name of the bank. Infinex and the bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of the principal amount invested.